Translating Insights Into Results

To consistently add value to client portfolios across all economic and market cycles, we adhere to a disciplined, well-defined process.

A Disciplined

Portfolio Management Approach

At Chandler, we apply a consistent, disciplined investment process designed to add value through all phases of the economic and market cycle. At the core of our portfolio construction approach is the Horizon Analysis Model—a proprietary, quantitative framework developed to align strategy with opportunity.

This model allows our investment management team to systematically translate research insights into actionable portfolio decisions. It supports a data-driven, repeatable process that reinforces transparency, rigor, and accountability.

Key inputs to the Horizon Analysis Model include:

- Current yields on Treasury, agency and corporate securities.

- Specific client constraints, such as maturity restrictions and maximum sector exposure.

- A thorough range of forecasted interest rate scenarios based upon a six-month horizon date.

| Fixed Income Strategies (as of 9/30/2025) | Yield | Duration | Quality | Profile |

|---|---|---|---|---|

| Limited Maturity | 3.83% | 1.83 | AA+ | Download |

| Short Term Bond | 3.85% | 2.55 | AA+ | Download |

| All Corporate | 4.02% | 2.14 | A+ | Download |

| Intermediate Bond | 3.93% | 3.48 | AA+ | Download |

| 1-10 Year Govt / Corporate | 4.06 | 3.68 | AA | Download |

| Core Bond | 3.42% | 4.75 | AA+ | Download |

| Chandler’s Core Bond strategy seeks to achieve above-benchmark returns consistently throughout market cycles with low volatility relative to the ICE BofA US Corporate, Government and Mortgage Index. | ||||

| Asset Allocation Strategy (as of 9/30/2025) | Profile |

|---|---|

| Multi-Asset Class | Download |

| Chandler’s Multi-Asset Class (“MAC”) Strategy invests in a well-diversified portfolio of financial assets, including stocks, fixed income securities, commodities, and REITs. The MAC strategy seeks to add value through a disciplined, quantitative and qualitative process. | |

An Investment Framework

Driven by your Goals

Your goals drive our strategy. Our expertise shapes your outcomes. Together, we build tailored portfolios to help you navigate the curve with confidence.

Our approach is built around your unique mission. We start by listening. Every portfolio is carefully constructed and actively managed to reflect your priorities, constraints, and risk tolerance. Our disciplined process is designed to deliver consistent, policy-aligned results—even as markets shift.

Horizon Analysis Model

We begin each engagement by understanding your liquidity needs, policy parameters, and long-term goals. Our proprietary Horizon Analysis Model simulates thousands of yield curve and spread scenarios to identify the duration, sector allocation, and maturity structure best suited to your objectives.

Inputs include:

- Current and forecasted interest rates

- Liquidity requirements and cash flow projections

- Investment policy constraints and state statutes

- Economic and credit outlooks

Portfolio Construction & Security Selection

We build high-quality fixed income portfolios aligned with your investment policy and grounded in rigorous analysis. Our security selection process incorporates:

- Credit research and issuer due diligence

- Relative value analysis across sectors and durations

- Risk budgeting and duration management

Active Oversight and Risk Management

Chandler continuously monitors your portfolio to ensure it remains aligned with your goals and policy guidelines. Our proprietary compliance systems proactively flag deviations, so you don’t have to worry about staying within the bounds of your investment policy.

We adjust strategies as market conditions evolve - rebalancing, testing scenarios, and reviewing performance - all without compromising your policy or fiduciary standards.

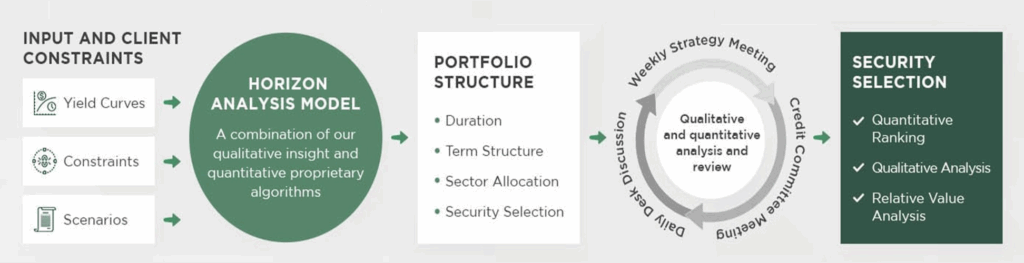

INPUT AND CLIENT CONSTRAIN TS

- Yield Curves

- Constraints

- Scenarios

PORTFOLIO STRUCTURE

- Duration

- Term Structure

- Sector Allocation

- Security Selection

SECURITY SELECTION

- Quantitative Ranking

- Qualitative Analysis

- Relative Value Analysis

Proprietary quantitative Horizon Analysis Model suggests target duration, sector allocation and term structure.

The security selection process employs quantitative tools and rigorous qualitative analysis to determine relative value.

INPUT AND CLIENT CONSTRAINTS

- Yield Curves

- Constraints

- Scenarios

HORIZON ANALYSIS MODEL

A combination of our qualitative insight and quantitative proprietary algorithms.

PORTFOLIO STRUCTURE

- Duration

- Term Structure

- Sector Allocation

Qualitative and quantitative analysis and review

SECURITY SELECTION

- Quantitative Ranking

- Qualitative Analysis

- Relative Value Analysis

Want to Talk About Your Portfolio?

Speak with an expert about what a partnership could look like.